Let’s be honest. Your business’s online identity is probably scattered across a dozen different platforms. You’ve got a login for your bank, another for your payment processor, profiles on social media, and credentials for government portals. Each one is a little piece of you, held in someone else’s vault. What if you could pull all those pieces together into one, unified, sovereign digital identity that you actually own and control?

That’s not just a tech dream anymore. It’s becoming a strategic necessity. For entrepreneurs and small business owners especially, building a sovereign identity is like moving from a rented apartment to owning your own land. You’re not just a tenant anymore; you’re the landlord. And that shift changes everything.

What Exactly Is a Sovereign Digital Identity? (And What It’s Not)

Okay, let’s clear the air first. A sovereign digital identity isn’t just a fancy digital business card or a slick LinkedIn profile. It’s deeper than that. Think of it as a self-contained, verifiable portfolio of your business’s credentials, reputation, and legal standing. You store it in a digital wallet you control—often called a “digital identity wallet”—and you choose when, where, and with whom to share parts of it.

Here’s the core idea: instead of asking Facebook to log you into a service, or your bank to verify your address for a loan, you present a cryptographically signed credential from your own wallet. The verifier trusts the credential’s signature, not the platform it came from. It cuts out the middleman. It’s about portability and autonomy, honestly.

The Pain Points It Solves—Right Now

Why bother? Well, the friction in business operations is real. You know the drill:

- Onboarding Hell: Every new client, partner, or platform requires you to submit the same documents. Your business license, tax ID, proof of address… it’s a repetitive, manual time-suck.

- Fraud and Impersonation: It’s way too easy for bad actors to create fake business profiles or impersonate legitimate companies online. Trust is fragile.

- Data Breach Anxiety: Your sensitive business data sits in corporate databases that are constant targets for hackers. You’re only as secure as their weakest link.

- Platform Lock-in: Your reputation and network are trapped within platforms like Upwork or Amazon. Try taking that five-star history with you to a competitor’s site. You can’t.

A sovereign identity framework tackles these head-on. It turns your business’s verified attributes into reusable assets, not one-time submissions.

The Building Blocks: How It Actually Works

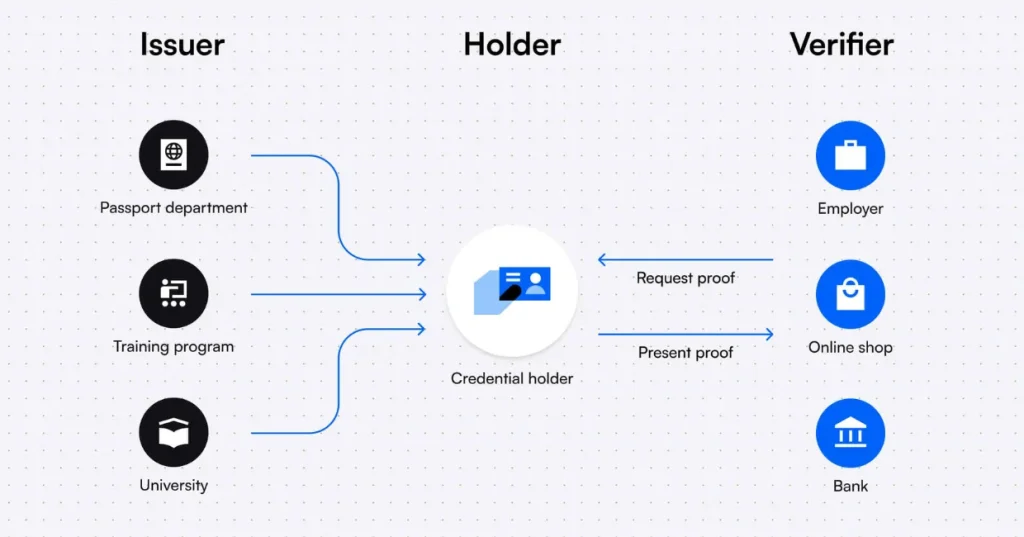

This isn’t magic, it’s architecture. The whole system rests on a few key concepts, which I’ll try to explain without getting too deep in the weeds.

1. Decentralized Identifiers (DIDs)

This is your business’s unique, global identifier. But unlike an email address (owned by Google) or a username (owned by Twitter), a DID is generated and controlled by you. It’s registered on a decentralized network—like a blockchain or a distributed ledger—so no single company can take it away or turn it off. It’s the foundation.

2. Verifiable Credentials (VCs)

These are the digital equivalent of physical credentials. Imagine your business license, but as a tamper-proof digital file. A trusted issuer—say, your state’s Secretary of State office—signs it cryptographically and gives it to you. You store it in your wallet. Later, when a supplier needs to verify you’re a legitimate entity, you share just that credential. They can check the signature instantly. No calls, no PDFs, no doubt.

3. The Identity Wallet

This is your command center. A secure app on your device where you hold your DIDs and your collection of VCs. Its job is to manage consents and sharing. You get to decide: do you share just your business name and registration status? Or do you also include your professional certifications and credit rating? The power of selective disclosure is a game-changer for privacy.

| Traditional Model | Sovereign Identity Model |

| Identity stored in siloed databases | Identity held in user-controlled wallet |

| You are the product (data for sale) | You are the owner (data for consent) |

| Re-verify everywhere, repeatedly | Verify once, reuse everywhere |

| High friction, slow onboarding | Low friction, “click-to-prove” speed |

The Tangible Benefits for Your Bottom Line

This all sounds good in theory, but what’s the practical payoff? Let’s talk real business value.

Operational Velocity. Imagine closing a new B2B client in minutes, not days. You send a request for their payment terms credential; they send a request for your business license and insurance proof. A few clicks later, with trust established automatically, the contract is signed. The speed is… well, it’s transformative.

Reduced Compliance Overhead. For sectors like fintech or healthcare, Know Your Business (KYB) checks are a huge cost center. Sovereign identity can automate up to 80% of that manual verification work. That’s staff time and money back in your pocket.

Unlocking New Markets. Want to participate in a decentralized finance (DeFi) protocol or join a global supplier network built on Web3 principles? A sovereign identity is often your ticket in. It’s the trust layer for the new, open internet.

And here’s a subtle one: reputation portability. You could, in theory, build a verifiable record of successful projects, client testimonials, and ethical certifications that you carry with you across platforms. Your reputation becomes an asset you own, not just a metric on a platform you rent.

Getting Started: A Realistic Path Forward

You don’t need to rebuild your entire tech stack tomorrow. The shift towards sovereign identity for businesses is more of an evolution. Here’s a practical way to think about it.

- Educate & Experiment. Start by learning the language. Follow what organizations like the Decentralized Identity Foundation (DIF) or the W3C are doing. Maybe try out a digital wallet app that supports VCs.

- Identify Your Key Credentials. What are the most painful documents you have to share repeatedly? Your business registration? Professional licenses? Tax compliance certificates? These are your prime targets for digitization.

- Engage with Forward-Thinking Partners. Is your bank piloting a digital credentials program? Is an industry association exploring verifiable certificates? Get involved. Early adoption here builds strategic advantage.

- Demand Better from Service Providers. Ask your SaaS vendors, your payment gateways, your government agencies: “Do you support login with verifiable credentials?” Consumer pressure drives adoption faster than anything else.

Look, the infrastructure is still being paved. Standards are coalescing, but they’re not everywhere yet. That’s okay. The point is to start thinking like a sovereign entity now. To start asking, “Who holds the keys to my business’s digital self?”

The Bigger Picture: Beyond Convenience

In the end, this is about more than slick logins and faster onboarding—though those are great benefits. It’s about the fundamental nature of business in a digital world.

Building a sovereign digital identity is a declaration of independence. It’s a move away from a model where your digital existence is a liability managed by others, toward a model where it’s an asset controlled by you. It reshapes power dynamics, reduces systemic risk, and—frankly—returns a sense of agency that the current internet has slowly eroded.

The trajectory is clear. The web is slowly reorganizing itself around principles of user-centric data control. Businesses that build their sovereign identity now aren’t just preparing for a trend. They’re laying the foundation for resilience, trust, and autonomy in the next era of commerce. They’re not just building a better login system; they’re staking a claim to their own digital future.